You have 0 items in your cart

The 2018 Budget was introduced by Minister Pascal Donohoe, in his first Budget speech, to the Dail on the 10 October 2017. The Minister announced no changes to CAT exempt thresholds. The taxable rate stays at 33% and the long requested increase for the threshold between parent and child remains the same . There will be no increase much to the disappointment of those advocating a higher threshold for the passing on of the family home .

The 2018 Budget was introduced by Minister Pascal Donohoe, in his first Budget speech, to the Dail on the 10 October 2017. The Minister announced no changes to CAT exempt thresholds. The taxable rate stays at 33% and the long requested increase for the threshold between parent and child remains the same . There will be no increase much to the disappointment of those advocating a higher threshold for the passing on of the family home .

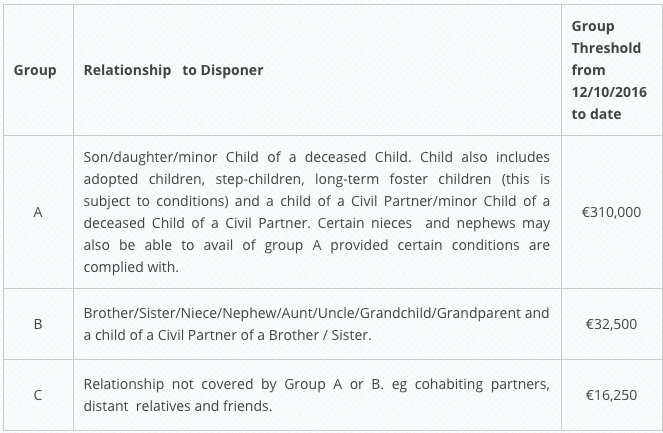

The current thresholds are:

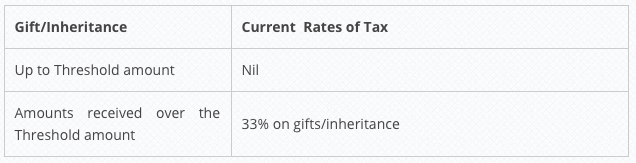

Gifts/Inheritances received by a beneficiary above the threshold amount are subject to inheritance tax.

The current rate of tax payable by a beneficiary is: